Dynasty Global Convertibles fund gained +11.3% in 2023, one of the very best funds to achieve double-digit growth, ranking among the top three funds in its category !

Our convertible bond strategy aims for long-term capital growth. Our strategies are available through a European and Global approach.

Our result validates our selective and pragmatic approach. It is not because a new issue is eligible in the benchmarks that we are going to participate.

On the contrary, our positions mainly depend on our convictions on each issuer, such as Palo Alto, BE Semiconductor, and Schneider. Through our emblematic position Booking, we also managed to take advantage of the opportunities emerged after the pandemic in the transport and tourism sectors.

In 2023, we were selective on the primary market. In 2024, the pace of issuance is likely to accelerate for several reasons.

Firstly, the high level of interest rates, without speculating on central banks’ moves in the coming months, will push issuers to reduce the coupons of their refinancings thanks to convertible bonds. Saving 2-3 points of coupon yearly can offset the dilution risk.

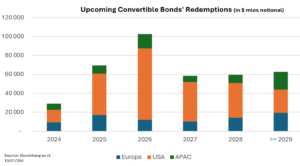

Moreover, refinancing by corporates will truly begin in 2024. We can expect new issuers to join the ranks of regular issuers of our asset class.

Finally, the need for short-term working capital refinancings will push more issuers to consider this type of issuance to bolster their liquidity and financial strength.

This view implies for us an approach similar to past years, meaning pragmatism and risk management: a moderate and controlled delta, a diversified portfolio of ca. 60 securities, moderate credit risk around BBB and high reactivity if 2024 is different to 2023, which was characterised by low volatility and credit risk.

The convertible market has been twice as big in the past, with $650 billion market size versus $370 billion currently. There is therefore considerable scope for our asset class to gain in liquidity. North America will probably remain the leading market, with over 60% of the market. However, the same financing needs will emerge in Asia and Europe, where market valuations are far more attractive than in the USA for instance. Monetary policies, multiple political elections and geopolitical risks will also be determining factors, as they were in 2023. We therefore expect convertibles to keep delivering a great performance in the year ahead.